The quote to cash process, similar to the order to cash process, is the process of understanding a potential customer’s needs, delivering the service, and collecting payment.

It seems straightforward but there are many moving pieces. If any step in the process is done poorly, it can derail the entire process.

In this guide, you’ll learn the major steps in the quote to cash process, the key components, challenges you may experience, and much more.

Overview of the Quote to Cash Process

Quoting: The Quote to Cash (Q2C) process begins with quoting, where potential customer requirements are analyzed, and a proposal detailing pricing and services is presented. This phase involves understanding the customer’s needs, offering suitable solutions, and providing transparent pricing information.

Contract Negotiation: Following the acceptance of the quote, the process moves into contract negotiation, where terms and conditions are finalized to formalize the agreement between the buyer and seller. This stage often involves discussions on pricing, delivery schedules, and any specific requirements to ensure mutual understanding and satisfaction.

Order Fulfillment: Once the contract is agreed upon and signed, the focus shifts to order fulfillment, where the products or services outlined in the contract are delivered or provided to the customer. This step involves coordinating various internal departments, such as production, logistics, and customer service, to ensure timely delivery and meet the customer’s expectations.

Invoicing: Simultaneously with order fulfillment, invoicing is initiated, where an invoice detailing the agreed-upon pricing and terms is sent to the customer. Accuracy and clarity in invoicing are critical to avoiding disputes and facilitating prompt payment.

Payment Collection: The Q2C process concludes with payment collection, where efforts are made to secure payment for the products or services provided. This phase may involve following up on outstanding invoices, resolving any billing discrepancies, and coordinating with the finance department to reconcile payments. Effective payment collection practices are essential for maintaining healthy cash flow and sustaining business operations.

Key Components of the Quote to Cash Process

The Quote to Cash (Q2C) process comprises several key components essential for facilitating smooth transactions and efficient revenue generation.

Firstly, quoting and pricing tools are used in the initial stages. They enable you to accurately assess customer requirements and generate comprehensive quotes.

These tools streamline the pricing process by integrating pricing models, discounts, and promotions, ensuring transparency and consistency in pricing across various sales channels.

Contract management systems provide a centralized platform for negotiating, drafting, and finalizing contracts.

These systems facilitate collaboration between sales teams, legal departments, and customers, ensuring that contracts are compliant, legally binding, and align with business objectives.

Order management systems help seamlessly manage the entire order fulfillment process. From order creation to delivery, these systems automate workflows, track inventory levels, and optimize order processing.

This makes it possible for you to fulfill customer orders accurately and on time. Integration with other systems such as inventory management and shipping further enhances operational efficiency.

Billing and invoicing systems are integral to the Q2C process. It facilitates the generation of and sending invoices promptly upon order completion.

These systems automate invoicing processes, generate accurate invoices based on contract terms and order details, and support various billing methods and currencies.

Additionally, they provide features for managing billing disputes, processing credits, and maintaining comprehensive billing records for auditing and reporting purposes.

Finally, payment processing solutions facilitate timely and secure payment collection. These solutions support multiple payment methods, including credit cards, electronic funds transfer, and online payment gateways, offering customers flexibility and convenience in settling their invoices.

Integration with billing and invoicing systems streamlines the reconciliation process and improves payment records accuracy, contributing to improved cash flow management and financial visibility.

Overall, these key components work cohesively to optimize the Quote to Cash process, enabling businesses to streamline operations, enhance customer satisfaction, and drive revenue growth.

Benefits of an Efficient Quote to Cash Process

Accelerated Sales Cycles: An efficient Quote to Cash (Q2C) process streamlines the sales cycle by reducing the time it takes to generate quotes, negotiate contracts, fulfill orders, and collect payments. With quicker turnaround times, you can capitalize on opportunities faster, leading to increased win rates and accelerated revenue generation.

Increased Revenue and Profitability: By minimizing delays and bottlenecks in the Q2C process, you can optimize revenue streams and enhance profitability. Quicker order fulfillment and invoicing lead to faster revenue recognition, while efficient pricing strategies and contract management contribute to maximizing margins.

Moreover, improved cash flow management resulting from timely payment collection enables you to reinvest profits into growth initiatives.

Improved Accuracy and Consistency: An efficient Q2C process relies on standardized workflows, automated systems, and centralized data management, which enhance accuracy and consistency throughout the sales cycle.

Automated quoting and invoicing reduce errors associated with manual data entry, while contract management systems ensure that terms and conditions are applied consistently across all agreements. This not only reduces the risk of disputes and billing discrepancies but also strengthens trust and credibility with customers.

Enhanced Customer Satisfaction: Prompt responses to quote requests, clear and transparent pricing, and timely order fulfillment demonstrate reliability and professionalism, instilling confidence in customers.

Additionally, efficient payment processing and billing practices contribute to a positive customer perception, as they experience hassle-free transactions and timely resolution of any billing issues.

Overall, improved customer satisfaction leads to higher retention rates and positive word-of-mouth referrals, driving sustained business growth.

An efficient Quote to Cash process not only accelerates sales cycles and increases revenue but also enhances accuracy, consistency, and customer satisfaction, positioning businesses for long-term success and competitiveness in the marketplace.

Common Challenges in the Quote to Cash Process

Inconsistent Pricing and Discounting: One of the primary challenges in the quote to cash (Q2C) process is maintaining consistent pricing and discounting practices across different sales channels and customer segments.

You may face difficulties in ensuring that quotes align with profitability targets and market competitiveness. Inconsistent pricing and discounting can lead to revenue leakage, eroding margins, and damaging customer relationships due to perceived unfairness.

Manual Processes Leading to Errors and Delays: Manual processes, such as manual data entry and document handling, are prone to errors and inefficiencies. This causes delays and inaccuracies throughout the Q2C process.

Relying on spreadsheets, emails, and paper-based documents increases the risk of data entry mistakes, misplaced documents, and communication breakdowns between teams.

These errors and delays not only impact customer satisfaction but also hinder revenue recognition and cash flow management.

Lack of Integration Between Systems and Departments: Siloed data and disconnected workflows impede visibility and collaboration, leading to communication gaps, redundant tasks, and process inefficiencies.

Without seamless integration, businesses struggle to access accurate and real-time information, hindering decision-making and responsiveness to customer needs.

Compliance and Legal Issues: Compliance with regulatory requirements and adherence to legal standards pose significant challenges in the Q2C process, especially for businesses operating in highly regulated industries or dealing with complex contractual agreements.

Ensuring that contracts comply with legal and regulatory frameworks, managing intellectual property rights, and addressing data privacy and security concerns require meticulous attention to detail and expertise. Failure to address compliance and legal issues adequately can result in legal disputes, financial penalties, and reputational damage.

Addressing these challenges requires a strategic approach that focuses on implementing standardized pricing policies, automating manual processes through technology solutions, fostering cross-functional collaboration, and prioritizing compliance and risk management efforts.

By overcoming these obstacles, you can streamline Q2C processes, improve operational efficiency, and enhance customer satisfaction while mitigating risks and maximizing revenue opportunities.

Best Practices for Optimizing the Quote to Cash Process

Streamlining Workflows and Eliminating Bottlenecks: Map out the entire Q2C process, from quoting to payment collection. You can then identify areas for improvement and implement strategies to streamline processes, reduce manual handoffs, and accelerate decision-making.

Continuous monitoring and analysis of key performance indicators (KPIs) help identify bottlenecks and inefficiencies, enabling organizations to implement targeted improvements and ensure smooth flow throughout the Q2C lifecycle.

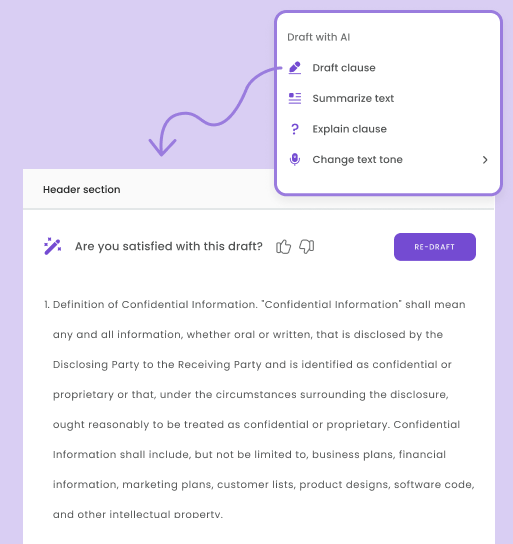

Implementing Automation and Digitalization: Automation and digitalization play a critical role in optimizing the Q2C process by reducing manual tasks, minimizing errors, and improving efficiency.

Implementing software solutions, such as customer relationship management (CRM) systems, contract management platforms, and billing and invoicing software, enables you to automate quote generation and repetitive tasks, standardize processes, and enhance visibility and control over the Q2C lifecycle.

Leveraging technologies such as artificial intelligence (AI) and machine learning (ML) can further streamline processes, improve forecasting accuracy, and enhance decision-making capabilities.

Standardizing Pricing and Discounting Policies: By establishing clear guidelines and controls for pricing and discounting, you can prevent revenue leakage, maintain margins, and avoid conflicts with customers.

Implementing pricing optimization tools and analytics solutions enables you to analyze market trends, competitor pricing, and customer preferences to develop strategic pricing strategies that maximize revenue and competitiveness while balancing customer value.

Enhancing Collaboration Between Sales, Finance, and Operations Teams:

Create a culture of collaboration and cross-functional communication to break down silos, improve information sharing, and enhance decision-making across departments.

Implementing integrated systems and tools that enable real-time access to relevant data and insights facilitates collaboration and enables teams to work cohesively towards common objectives.

Additionally, regular meetings, training sessions, and performance reviews help reinforce collaboration and accountability, driving continuous improvement and innovation in the Q2C process.

By adopting these best practices, you can optimize their Quote to Cash process, improve efficiency, reduce costs, and enhance customer satisfaction, ultimately driving sustainable growth and competitiveness in the marketplace.

Conclusion

The quote to cash process has many moving pieces that can benefit or hinder you.

When done properly, you generate more revenue and create a better experience for your customers.

This guide has walked you through the key components of the quote to cash process, the main things to look out for, and key best practices. Let me know what you think in the comments and don’t forget to share.