In business, we often overlook the little things that can make or break the customer experience. One of those little things is the order to cash process.

If you have a difficult or convoluted process, many people will give up partway. Or, if the item is important, they’ll buy but then start looking for another vendor immediately.

In this guide, you’ll learn what the order to cash process is, the key components associated with it, and some best practices to create an optimal order to cash process.

Overview of the Order to Cash Process

The Order to Cash (O2C or OTC) process is a critical business workflow that encompasses the entire lifecycle of a customer order, from initiation to payment collection. Each step in the O2C process plays a vital role in ensuring customer satisfaction, timely delivery of goods or services, and efficient revenue generation.

Order Initiation:

The O2C process begins with order initiation, where a customer places an order for goods or services. This could occur through various channels such as online portals, email, phone, or in-person interactions.

The accuracy and completeness of order information provided by the customer at this stage are crucial for subsequent processing steps.

Order Processing:

Once an order is received, it undergoes processing to verify the details, check product availability, and confirm pricing and discounts.

This step involves coordination between various departments such as sales, inventory management, and pricing to ensure that the order can be fulfilled according to customer expectations and business requirements.

Order Fulfillment:

After order processing is complete, the order moves to the fulfillment stage, where the goods or services are prepared for delivery or shipment to the customer.

This involves tasks that include picking, packing, and shipping products, and generating shipping labels and documentation.

Efficient order fulfillment is essential for meeting delivery deadlines and maintaining customer satisfaction.

Invoicing:

Once the order has been fulfilled, an invoice is generated and sent to the customer, detailing the products or services provided, along with pricing, taxes, and any applicable discounts or promotions.

The invoice serves as a formal request for payment and provides the customer with the necessary information to reconcile their accounts payable.

Accuracy and timeliness in invoicing are critical for ensuring prompt payment and maintaining positive relationships with customers.

Note that the invoicing process and payment can occur before order fulfillment. It depends on the nature of the goods and services that are provided.

Payment:

Upon receiving the invoice, the customer processes the payment through various channels such as credit card, electronic funds transfer, or check.

Payment processing may involve additional steps such as validation, authorization, and reconciliation to ensure accuracy and compliance with financial regulations.

Timely payment is essential for maintaining cash flow and meeting financial obligations.

Collections:

In cases where payment is not received by the due date, the collections process is initiated to follow up with the customer and secure payment.

This may involve sending reminders, making collection calls, and negotiating payment arrangements.

Effective collections management helps minimize overdue accounts and reduces the risk of bad debt, thereby preserving profitability and financial stability.

The order to cash process encompasses several interconnected steps, including order initiation, processing, fulfillment, invoicing, payment, and collections.

Each step plays an important role in ensuring efficient order management, timely delivery of goods or services, and effective revenue generation.

By optimizing each stage of the O2C process, you can enhance customer satisfaction, streamline operations, and maximize financial performance.

Key Components of the Order to Cash Process

Customer Relationship Management (CRM):

Customer relationship management (CRM) is a fundamental component of the order to cash process, encompassing the tools and strategies used to manage interactions and relationships with customers throughout the order lifecycle.

CRM systems capture and centralize customer data, including contact information, purchasing history, and preferences. This enables you to tailor your sales and marketing efforts, anticipate customer needs, and provide personalized service.

By integrating CRM into the O2C process, you can enhance customer satisfaction, increase sales effectiveness, and foster long-term loyalty and retention.

Sales Order Management:

Sales order management involves processing and tracking customer orders from initiation to fulfillment. This includes capturing order details accurately, verifying product availability, confirming pricing and discounts, and managing order changes or cancellations.

Sales order management systems automate and streamline these processes, enabling organizations to improve order accuracy, reduce processing times, and enhance visibility and control over the order pipeline.

Effective sales order management is essential for meeting customer expectations, optimizing inventory levels, and driving revenue growth.

Inventory Management:

Inventory management is a critical component of the order to cash process, ensuring that the right products are available in the right quantities at the right time to fulfill customer orders.

Inventory management systems track inventory levels, monitor stock movements, and optimize replenishment processes to minimize stockouts, excess inventory, and carrying costs.

By integrating inventory management with the O2C process, you can improve order fulfillment rates, reduce lead times, and enhance operational efficiency, ultimately driving customer satisfaction and profitability.

Billing and Invoicing Systems:

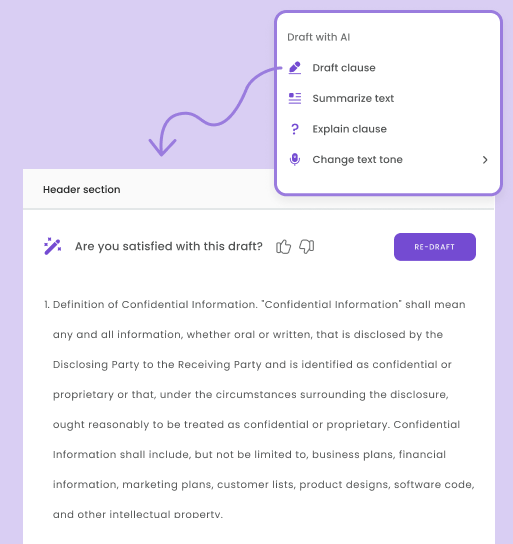

Billing and invoicing systems allow you to generate accurate and timely invoices, process payments, and manage accounts receivable.

These systems automate the invoicing process, allowing you to create invoices based on predefined pricing rules, apply discounts or promotions, and send invoices to customers electronically.

Billing and invoicing systems also support payment processing, reconciliation, and reporting, enabling you to track outstanding balances, monitor payment trends, and optimize cash flow.

By streamlining billing and invoicing processes, you can improve collections efficiency, reduce billing errors, and enhance financial visibility and control.

Accounts Receivable Management:

Accounts receivable management involves monitoring and collecting payments owed by customers for goods or services provided.

This includes sending invoices, tracking payment receipts, following up on overdue accounts, and resolving payment disputes or discrepancies. Accounts receivable management systems automate these processes, providing visibility into outstanding receivables, aging reports, and collection activities.

By proactively managing accounts receivable, you can accelerate cash flow, reduce bad debt, and improve overall financial performance, thereby strengthening liquidity and profitability.

The key components of the order to cash process include customer relationship management (CRM), sales order management, inventory management, billing and invoicing systems, and accounts receivable management.

By integrating these components into a cohesive and streamlined process, you can enhance customer satisfaction, optimize operational efficiency, and drive sustainable growth and profitability.

Common Challenges in the Order to Cash Process

Even though the order to cash process is important for organizations of all sizes, there are many challenges that, oftentimes, aren’t dealt with properly.

Below is a short list of things to be aware of and plan for.

Order Errors and Inaccuracies:

One of the primary challenges in the order to cash process is the occurrence of order errors and inaccuracies.

These errors can stem from various sources, including manual data entry mistakes, miscommunication between sales and fulfillment teams, and inaccuracies in pricing or product information.

Order errors and inaccuracies can lead to delays in order processing, fulfillment errors, and customer dissatisfaction.

Addressing this challenge requires implementing robust quality control measures, enhancing communication and collaboration between departments, and leveraging technology solutions such as automated order management systems to minimize errors and ensure order accuracy.

Delays in Order Processing and Fulfillment:

Delays in order processing and fulfillment pose significant challenges in the order to cash process, impacting customer satisfaction, cash flow, and operational efficiency.

These delays can result from factors such as inventory shortages, production bottlenecks, transportation delays, or inefficient order processing workflows.

Delays in order fulfillment can lead to missed delivery deadlines, increased costs associated with expedited shipping, and potential loss of sales or customers.

To mitigate this challenge, optimize inventory management processes, streamline order processing workflows, and establish clear communication channels with suppliers and logistics partners to ensure timely order fulfillment.

Invoice Disputes and Late Payments:

Invoice disputes and late payments are common challenges faced by organizations in the Order to Cash process, affecting cash flow management and accounts receivable performance.

Disputes may arise due to discrepancies between the invoice and the customer’s expectations or disputes over product quality, pricing, or delivery terms.

Late payments can result from customer financial difficulties, billing errors, or internal processing delays. To address this challenge, establish clear invoicing procedures, resolve disputes promptly through effective communication and negotiation, and implement strategies to encourage timely payment, such as offering discounts for early payment or implementing automated payment reminders.

Integration Issues Between Systems and Departments:

Integration issues between systems and departments present significant challenges in the Order to Cash process, hindering data visibility, process efficiency, and collaboration.

Siloed systems and disparate data sources can lead to data inconsistencies, duplication of efforts, and delays in information sharing between departments such as sales, finance, and operations.

To overcome this challenge, organizations need to invest in integrated technology solutions that facilitate seamless data exchange and workflow automation across different systems and departments.

This may involve implementing enterprise resource planning (ERP) systems, customer relationship management (CRM) platforms, or middleware solutions to streamline data integration and enable cross-functional collaboration in the Order to Cash process.

Best Practices for Optimizing the Order to Cash Process

Implementing Automation and Digitalization:

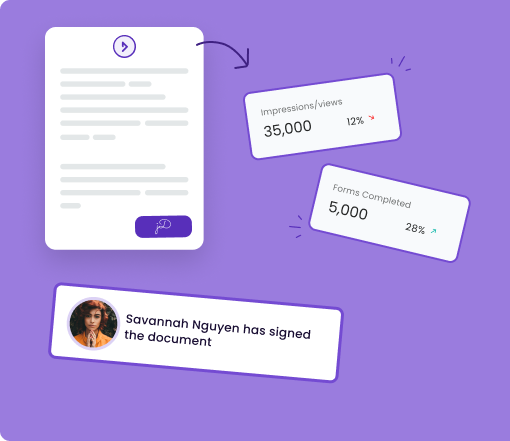

By leveraging technology solutions such as order management systems, electronic invoicing platforms, and automated payment processing tools, you can streamline manual tasks, reduce errors, and accelerate the order lifecycle.

Automation helps improve process efficiency, reduce processing times, and enhance scalability, allowing you to handle larger volumes of orders and transactions without compromising quality.

Additionally, digitalization enables real-time visibility into the order status, improves data accuracy, and enhances customer experience by providing self-service options for order tracking and payment processing.

Standardizing Processes and Workflows:

Establish clear and consistent procedures for order processing, fulfillment, invoicing, and collections to minimize errors, reduce delays, and improve overall process efficiency.

Document standard operating procedures (SOPs), define key performance indicators (KPIs), and implement workflow automation tools to enforce process adherence and ensure consistency across departments and locations.

Standardization also facilitates scalability and agility, allowing you to adapt to changing business requirements and market conditions more effectively.

Enhancing Communication and Collaboration Between Departments:

Enhancing communication and collaboration between departments is critical for optimizing the order to cash process.

Effective coordination between sales, finance, operations, and customer service teams ensures smooth handoffs, timely resolution of issues, and alignment of objectives throughout the order lifecycle.

Foster a culture of cross-functional collaboration, establish regular communication channels, and leverage collaboration tools such as project management software, shared calendars, and instant messaging platforms to facilitate information sharing and decision-making.

By breaking down silos and promoting collaboration, you can improve process visibility, reduce bottlenecks, and enhance customer satisfaction.

Continuous Monitoring and Performance Measurement:

Continuous monitoring and performance measurement are essential for optimizing the order to cash process.

Establish key performance indicators (KPIs) such as order cycle time, order accuracy, days sales outstanding (DSO), and customer satisfaction metrics to track process performance and identify areas for improvement.

Regular monitoring of KPIs allows organizations to detect inefficiencies, address root causes, and implement corrective actions promptly.

Additionally, organizations should leverage data analytics and reporting tools to gain insights into process trends, customer behavior, and market dynamics, enabling data-driven decision-making and continuous process optimization.

Best practices for optimizing the Order to Cash process include implementing automation and digitalization, standardizing processes and workflows, enhancing communication and collaboration between departments, and continuous monitoring and performance measurement.

By adopting these best practices, you can streamline operations, improve customer satisfaction, and drive sustainable growth and profitability through more efficient Order to Cash processes.

Conclusion

The order to cash process is important and has many moving pieces. As you’re well aware, the more complex the process, the more opportunities for mistakes and failures.

This guide has broken down the key steps in the order to cash process, the challenges you may experience, and best practices to incorporate. Let me know what you think in the comments and don’t forget to share.