Many people consider the insurance industry a necessary evil. One that’s slow-moving, opaque, and inefficient. This isn’t without reason.

On average, it can take around 30 days to get a decision on a claim for simple matters and another 30 days to receive a payout. Of course, this varies by state and the complexity of the situation.

A lot of this time is spent on the reams of paperwork that need to be filled out and processed. Insurance document automation can drastically cut down the time it takes to handle insurance documentation.

In this guide, you’ll learn what insurance document automation is, the benefits it brings to the table, and various use cases.

What is insurance document automation?

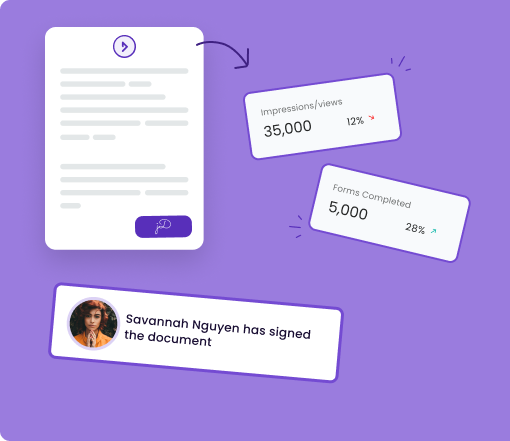

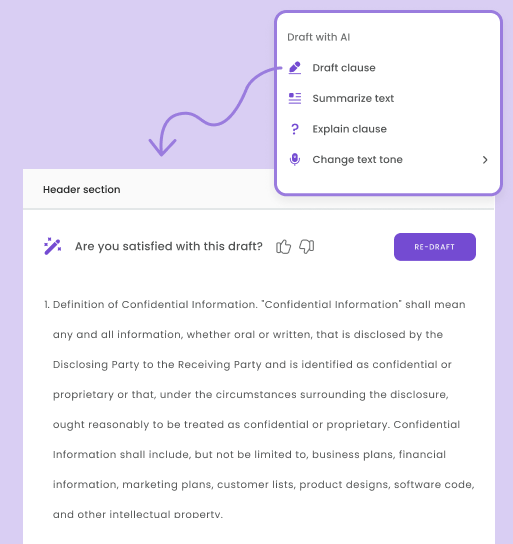

To understand insurance document automation, it’s necessary to know what document automation is. It’s the process of using technology, – usually in the form of software – to gather relevant data, generate a document from that data, and perform various post-creation activities such as storage, signing, etc.

Insurance document automation is simply document automation specifically designed for the insurance industry. This includes performing tasks such as policy creation, underwriting, and claims processing. Because of this focus, the solution you use may have features specific to the insurance industry.

That doesn’t mean people within other industries or in different functional roles can’t take advantage of the software. It’s just that it wasn’t built with them in mind.

Now that we’re clear on what insurance document automation is, let’s look at some of the benefits associated with it and how they can impact you.

Benefits of insurance document automation

1. Increased Efficiency

One of the primary benefits of insurance document automation is increased efficiency. Insurance companies handle large volumes of paperwork every day – including policy applications, claims forms, and underwriting documents.

These documents are often complex, and processing them manually can be time-consuming and prone to errors. An error with insurance document processing can lead to many problems which include incomplete policy coverage or fines from regulatory bodies.

By automating the creation, storage, and retrieval of these documents, you can streamline your processes and reduce manual labor. This can save time and increase productivity, allowing you to process claims and underwriting applications faster and more efficiently. This has the added benefit of improving the overall customer experience which we’ll get into a bit later.

2. Improved Accuracy

Manual processing of insurance documents is prone to errors, which can result in delayed processing times, inaccurate policy terms, and even regulatory violations.

The problem is that errors are bound to happen – especially with complex documents. According to a study published by Professor Raymond R. Panko, there’s a 100% chance of error with manual data entry for complex spreadsheets.

Extrapolating a bit, we can say the same thing for complex documents. You will have at least one error – usually more. S single error usually isn’t a big deal and can be easily corrected. For insurance, especially for something like health or auto insurance, it can have an outsized negative impact. This applies to the insurance company and the insured person.

Insurance document automation can help prevent these errors and improve the accuracy of the documentation that’s being processed.

3. Enhanced Security

Insurance companies deal with sensitive customer data, including personal and financial information. This data must be kept secure to comply with regulations and protect customer privacy. Manual processing of insurance documents can put this sensitive data at risk of theft, loss, or unauthorized access.

Insurance document automation can help mitigate these risks by providing enhanced security features. For example, automated document management systems can encrypt data, control access to sensitive documents, and monitor document activity to detect suspicious behavior. This can help insurance companies comply with regulations and protect customer data from cyber threats.

4. Improved Customer Service

Insurance companies often face challenges when it comes to providing excellent customer service. One of the most common issues is the delay in processing claims, which can leave customers frustrated and dissatisfied. Insurance document automation can help you improve customer service by reducing processing times and providing faster access to policy information.

With automation technology, you can process claims faster, provide instant policy quotes, and offer real-time updates on policy status. This can help you deliver better customer service and improve customer satisfaction. Improved customer satisfaction leads to more organic referrals and more revenue. It’s a virtuous cycle.

5. Cost Savings

By reducing manual labor and increasing efficiency, automation technology can help lower operational costs. This can result in significant cost savings over time.

Additionally, insurance document automation makes it easier to avoid costly errors and regulatory violations. These types of mistakes can result in hefty fines, lawsuits, and reputational damage. By using automation technology to ensure the accuracy of your documents, you can avoid these types of costly mistakes.

Use cases of insurance document automation

Just like there are many benefits, there are many use cases of insurance document automation – both internally and externally. Here, I’ll just touch on a few but you’ll likely find many more ways to take advantage of this technology as you become more familiar with it:

1. Claims Processing

Claims processing involves collecting, analyzing, and verifying a wide range of information from various sources, including policy details, medical records, and accident reports. With insurance document automation, insurers can streamline this process by automatically capturing and processing data from claims documents.

By automating claims processing, you can reduce the time taken to process claims and improve customer satisfaction. The automation can also help identify inconsistencies and errors in claims data, leading to fewer disputes and improved accuracy.

2. Underwriting

Underwriting is the process of assessing the risk associated with insuring an individual or entity and determining the terms and conditions of the policy. It involves collecting and analyzing a wide range of data from various sources, including financial records, medical records, and legal records.

Insurance document automation can simplify this process by automating the creation and analysis of underwriting documents. You can also review financial and medical records quickly and create reports that provide a comprehensive view of the applicant’s risk profile. With this information at your fingertips, you can make informed underwriting decisions faster and more accurately.

3. Compliance

Compliance is a vital aspect of the insurance industry, and insurers must comply with various regulations and standards to protect customer data and ensure fair business practices. It requires the creation and management of various documents, including policies, procedures, and training materials.

Automation helps you streamline the compliance process by automating the creation, storage, and retrieval of compliance-related documents. At the same time, compliance elements are built into every automated workflow to make checks and balances easier.

Automation can help you create and store compliance-related documents, track and manage document revisions and approvals, and ensure compliance with regulations.

4. Fraud Detection

Fraud is a significant challenge in the insurance industry. It’s a top priority for you to detect and prevent fraud to minimize losses and protect your reputation. Insurance document automation can help insurers detect fraud by automating the analysis of insurance documents.

Automated systems can scan insurance documents for signs of fraud, such as inconsistencies in policy details, claims data, and patterns of behavior. By automating fraud detection, insurers can identify potential fraud more quickly and accurately, reducing the risk of financial losses and reputational damage.

Insurance document automation in policy management

While this is technically another use case of insurance document automation, it’s so important that it deserves its own section.

Policy administration is a crucial function of insurance companies. It involves managing policy documents, including applications, endorsements, and renewals, as well as storing and retrieving policy information. By automating policy administration, insurers can reduce the time taken to manage policy documents and improve accuracy.

- Policy Creation

It’s simple to automate the policy creation process by generating policies automatically based on pre-defined templates and rules. Most policies are templated so creating a dynamic document automation template to handle those processes is relatively straightforward.

By automating policy creation, you can reduce the time taken to create policies and ensure consistency in policy language and formatting. Additionally, it can improve customer satisfaction and increase goodwill because you’ll be perceived as efficient.

- Policy Storage and Retrieval

Insurance document automation can automate the storage and retrieval of policy documents by creating a centralized document repository that can be accessed by authorized users. This can help you manage policy documents more efficiently by reducing the need for manual searches and paper-based filing systems.

Automated document management systems can also provide quick access to policy information when required, improving the efficiency of policy management and reducing errors.

- Policy Analysis

Insurance document automation can automate the analysis of policy documents by extracting key policy information and analyzing it for inconsistencies and errors. Automated policy analysis makes it easier for you to identify policy gaps and inconsistencies and improve policy language and structure.

Automated analysis can also help you ensure compliance with regulatory requirements and avoid costly errors that could lead to claims disputes and legal liabilities.

- Policy Renewals and Endorsements

Automate policy renewals and endorsements by creating automated workflows that trigger notifications and alerts when policies are due for renewal or require endorsements.

Automated policy renewals and endorsements can help you reduce the time taken to process policy changes and ensure policy changes are accurate and consistent across all policy documents.

What to consider before using insurance document automation

Before using insurance document automation, there are several important considerations to keep in mind. These include:

- Business Needs and Goals: The first consideration is to assess your business needs and goals. Consider what processes you would like to automate and the specific outcomes you want to achieve. Think about the types of documents you need to process, the frequency of document processing, and the volume of documents you manage. Additionally, consider your compliance requirements and whether automation can help you achieve compliance goals.

- Cost-Benefit Analysis: Automation can deliver significant cost savings over time. However, it is important to perform a cost-benefit analysis to determine whether automation is financially feasible. This analysis should consider the costs associated with implementing automation, including any software or hardware requirements, the costs associated with maintaining the automation system, and the costs associated with ongoing or initial training.

- Data Security: Insurance documents often contain sensitive information, including personal and financial data. Before implementing automation, ensure that your automation system has robust security features to protect against data breaches and unauthorized access.

- Integration with Existing Systems: Another consideration is whether the automation system can integrate with your existing systems. The automation system should be able to integrate with other business systems, such as customer relationship management (CRM) systems or claims management systems, to streamline operations and minimize manual intervention.

- Training and Support: Automation systems can be complex, so it is important to ensure that your staff receives adequate training and support. Your vendor should provide comprehensive training and support services to help your staff understand how to use the automation system and troubleshoot any issues that may arise.

- Regulatory Compliance: Insurance companies must adhere to a wide range of regulations, including data privacy laws, anti-fraud regulations, and insurance-specific laws and regulations. Before implementing automation, ensure that your system is compliant with all applicable regulations.

- Technical Requirements: Finally, it is important to consider the technical requirements of the automation system. Determine whether the system is compatible with your tools, and whether your IT department has the necessary expertise to support the system.

Conclusion

Insurance document automation can be a powerful tool in your arsenal when used correctly. IT can reduce costs, increase efficiency, provide a better customer experience, and ensure your documentation is secure.

It does require an upfront investment in time and money so it’s essential for you to do a proper analysis. If you’re looking for a robust insurance document automation solution, be sure to check out DoxFlowy.