There are many ways to structure a deal when you’re buying a business or part of a business. Oftentimes, especially in smaller deals, you’ll be creating what’s known as an asset purchase agreement.

An asset purchase agreement has many moving pieces that are designed to offer protection to the buyer and seller. In this guide, you’ll learn what an asset purchase agreement is and the key elements to consider when creating your own.

Definition of an Asset Purchase Agreement

An Asset Purchase Agreement (APA) is a legal contract between two parties that outlines the terms and conditions of the sale and purchase of specific assets. Keep in mind that it can be for anything but it’s generally used to purchase assets of a business.

In this agreement, one party (the seller or transferor) agrees to sell and transfer certain assets to another party (the buyer or transferee). The assets involved in an APA can vary widely, ranging from tangible assets like equipment, inventory, and real estate, to intangible assets like intellectual property, customer contracts, and goodwill.

An APA serves as a comprehensive document that details the specifics of the transaction, including the assets being transferred, the purchase price, payment terms, representations and warranties, conditions precedent, indemnification provisions, and other relevant terms. It’s a critical legal instrument that helps ensure a smooth and well-defined transfer of ownership and responsibilities from the seller to the buyer.

Key Elements of an Asset Purchase Agreement

As mentioned previously, there are multiple moving pieces in an APA. Each one needs to be considered carefully and set up properly for the agreement to offer its full legal protection. Below, you’ll find the key elements and what each one entails.

Parties and Effective Date:

- Identification of Parties: The APA should clearly identify the buyer and the seller, including their legal names, addresses, and any relevant business details. In essence, you want to make sure there’s no confusion about who’s buying the assets and who is selling the assets.

- Effective Date: This is the date on which the agreement becomes legally binding. It’s important to specify when the terms and conditions of the agreement take effect.

Assets Being Transferred:

- Detailed Asset List: The APA should provide a comprehensive and detailed list of the assets that are being sold. This includes both tangible assets (like equipment, inventory, and real estate) and intangible assets (like intellectual property, contracts, and customer lists).

- Exclusions: Any assets that are not included in the sale should be clearly specified. This helps avoid confusion and ensures that both parties are aware of what is and isn’t being transferred.

Purchase Price and Payment Terms:

- Total Purchase Price: The APA should state the exact amount of money the buyer agrees to pay the seller for the assets. This amount can be a lump sum or subject to adjustments. It’s common when buying all the assets of a business to require the key personnel to stay on for a specified amount of time.

- Payment Structure: The agreement should outline how the purchase price will be paid. This could be through a lump-sum payment, installment payments, or other agreed-upon methods.

- Escrow: If a portion of the purchase price is being held in escrow for a certain period, the terms and conditions of the escrow arrangement should be clearly defined.

- Purchase Price Adjustments: If the purchase price is subject to adjustments based on certain factors (e.g., working capital adjustments, closing date valuation), the method for calculating and determining these adjustments should be explained.

Assumption of Liabilities:

- Liabilities to be Assumed: The APA should specify which liabilities and obligations will be assumed by the buyer as part of the asset transfer. This can include both known and contingent liabilities.

- Existing Contracts and Leases: If the buyer is taking over existing contracts, leases, or other obligations, the agreement should include provisions detailing how these agreements will be transferred and whether the buyer will be bound by the same terms.

Representations and Warranties:

- Seller’s Statements: The seller provides detailed representations and warranties about the assets being sold. These statements cover aspects such as ownership, title, condition, legality, and accuracy of provided information.

- Indemnification: The agreement should address the consequences of any breach of representations and warranties by the seller. Typically, the seller agrees to indemnify the buyer for any losses incurred due to such breaches.

Closing Conditions and Deliverables:

- Closing Conditions: The APA outlines the conditions that must be satisfied before the transaction can be completed. These conditions can include obtaining necessary regulatory approvals, conducting due diligence, and fulfilling any outstanding obligations.

- Exchange of Documents: The agreement should specify the documents, certificates, and other items that need to be exchanged between the parties at the closing of the transaction. This ensures a smooth transition of ownership.

Post-Closing Covenants:

- Transition Services: If the seller is required to provide certain services or assistance to the buyer post-closing (such as transition support, training, or technical assistance), the terms and conditions of these services should be outlined.

- Non-Compete Clauses: Any agreements prohibiting the seller from competing in a certain market or industry for a specified period after the transaction should be clearly defined.

- Employee Transition and Retention: If employees are being transferred with the assets, the agreement should detail how their employment terms, benefits, and responsibilities will be managed post-closing.

Dispute Resolution and Governing Law:

- Dispute Resolution Mechanism: The APA should lay out the process for resolving disputes that might arise from the agreement, whether through negotiation, mediation, arbitration, or litigation.

- Choice of Law: The agreement should state which jurisdiction’s laws will govern the interpretation and enforcement of the agreement.

Confidentiality and Non-Disclosure:

- Confidentiality Clauses: The agreement should include clauses that emphasize the confidentiality of sensitive information shared during the negotiation and execution of the agreement.

- Non-Disclosure Agreements (NDAs): Additional NDAs can be included to ensure parties do not disclose proprietary or confidential information to third parties.

Termination and Remedies:

- Termination Clause: The agreement should outline the circumstances under which the agreement can be terminated by either party, along with the consequences of such termination. Generally, there are specific provisions such as the seller misrepresented information or certain assets weren’t handed over to the buyer. Avoid clauses that allow anyone to cancel at any time.

- Remedies: The agreement should detail the available remedies if one party breaches the terms of the agreement, such as monetary damages or specific performance.

Miscellaneous Provisions:

- Entire Agreement: A clause stating that the APA constitutes the entire agreement between the parties, superseding any prior agreements or understandings.

- Waiver: Explanation that any failure to enforce a provision of the agreement does not waive the right to enforce it later.

- Amendment: The process by which the agreement can be modified or amended should be defined.

- Severability: A clause that ensures that if any part of the agreement is found to be unenforceable, the remainder of the agreement remains valid.

Keep in mind that an Asset Purchase Agreement can become quite detailed and intricate, depending on the nature of the transaction, the industry involved, and the preferences of the parties. The goal of the agreement is to provide a comprehensive framework that addresses all aspects of the asset transfer, mitigates potential risks, and clarifies the rights and responsibilities of both the buyer and the seller.

As with any legal document, it’s crucial to work with legal professionals who are well-versed in contract law and business transactions. They can help draft, review, and negotiate the terms of the agreement to ensure that it accurately reflects the intentions of the parties and provides adequate protection for all involved parties.

Conclusion

An asset purchase agreement is an important and useful document. It helps buyers and sellers spell out what is expected of each other. It also serves as a reference document during the handover process.

There are many elements to take into consideration and this guide will help you make sure you have everything you need to create a binding asset purchase agreement.

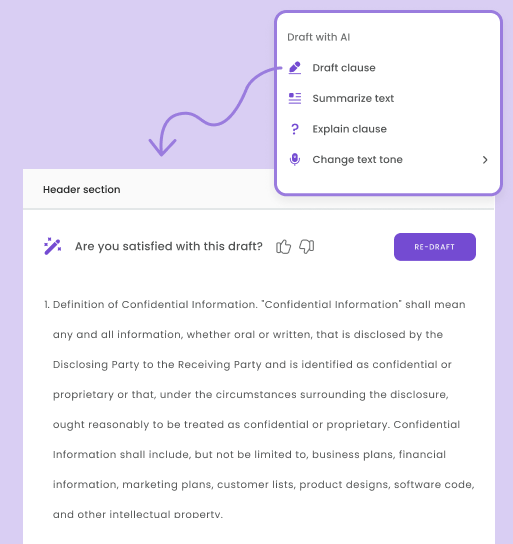

Take advantage of DoxFlowy’s CLM to prep and negotiate a strong APA that ensures you get what you need out of your asset purchase transaction.