Invoices are an essential part of business operations. For some, it can be a constant source of frustration but for others, it’s a seamless process.

The difference?

Understanding how to write an invoice effectively. Yes, like everything else in business, there’s a process that can and should be followed.

In this guide, you’ll learn exactly what an invoice is, how to write one for maximum results, and insights on how to automate the invoicing process so it’s easier for everyone involved.

What is an invoice?

An invoice is a document that lists the goods or services provided by a seller to a buyer, along with the cost of those goods or services. It is a request for payment from the seller to the buyer.

The invoice typically includes details such as the date of the transaction, the names and addresses of the buyer and seller, a description of the goods or services sold, the quantity of each item, the price per item, and the total amount due.

The invoice may also include payment terms, such as when the payment is due, any applicable discounts or taxes, and how the buyer should make payment to the seller. If there aren’t any specific instructions, there may be a payment link the buyer can use.

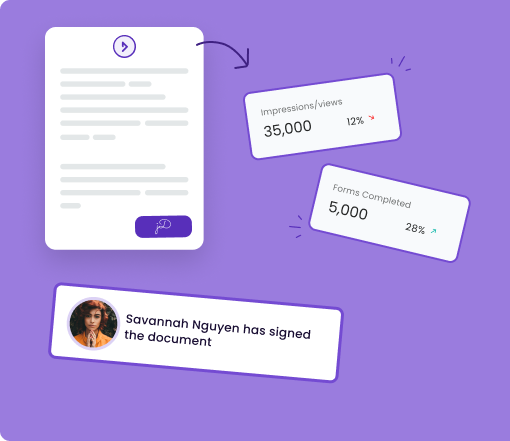

Invoicing is an important part of business transactions. They provide a record of the sale and help ensure that both parties understand the terms of the transaction. Invoices are often used with purchase orders or contracts to provide a complete picture of the transaction.

They can also serve as evidence of business dealings – especially when the invoice has been signed by the biuer.

What should be included in an invoice?

Many pieces of information can be included in an invoice. Some information is for convenience while other pieces of information are essential for the invoice to be valid. Below, you’ll find the things you should include to ensure you have an invoice that gets the job done:

- Seller Information: This includes the name, address, and contact information (email, phone, or both) of the seller or company issuing the invoice.

- Buyer Information: This includes the name, address, and contact information (email, phone, or both) of the buyer or company receiving the invoice.

- Invoice Number: A unique identifier for the invoice, used for tracking purposes.

- Invoice Date: The date on which the invoice was issued.

- Payment Due Date: The date by which the payment for the invoice is due. It’s common to issue invoices a few weeks before the payment deadline. This is especially true when sending an invoice to a larger company because they tend to take longer to pay.

- Description of Goods or Services: A detailed description of the goods or services provided, including quantities and unit prices.

- Total Amount Due: The total amount owed for the goods or services provided.

- Payment Terms: Any terms or conditions regarding payment, such as late fees, early payment discounts, or payment methods accepted.

- Tax Information: If applicable, the invoice should include any taxes or fees that are due.

- Additional Information: Any other information that is relevant to the invoice, such as a purchase order number or delivery date.

It’s important to ensure that all information on the invoice is accurate and clear, as any errors or omissions can cause delays in payment and can lead to confusion or disputes.

Different types of invoices

Several types of invoices are commonly used in business transactions. The one you use will depend on multiple factors which include who you’re sending the invoice to, the nature of the transaction, and the nature of your business. Some of the most common types of invoices include:

- Standard Invoice: A basic invoice that lists the goods or services provided, along with the price and any applicable taxes or fees. This is the most common type of invoice used.

- Proforma Invoice: A preliminary invoice that is issued before the actual goods or services are provided, which is used to provide an estimate of the costs involved in the transaction.

- Recurring Invoice: An invoice that is issued on a regular basis for ongoing services or subscriptions.

- Credit Memo: An invoice that is used to issue a credit to a customer’s account, typically to correct an error or to provide a refund.

- Debit Memo: An invoice that is used to charge additional fees or costs to a customer’s account, typically to correct an error or to recover costs that were not included in the original invoice.

- Time-based Invoice: An invoice that is based on the amount of time spent providing a service, rather than on a fixed price for goods or services.

- Commercial Invoice: An invoice that is used for international trade transactions, which includes details about the goods being shipped, the value of the shipment, and any taxes or duties that are due.

How to write an invoice

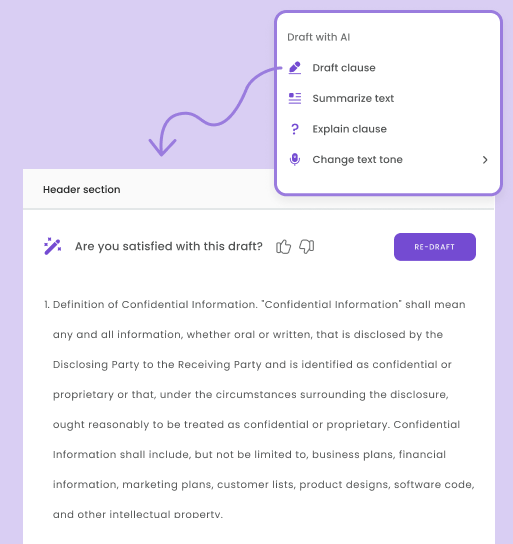

Create a professional invoice template:

You don’t need to create an invoice from scratch every time. In fact, it’s recommended that you don’t. Many tools can help you create high-quality invoices such as DoxFlowy. You can also tap into your payment processor and create invoices. Stripe, PayPal, and many others offer this service.

Include the information required for all invoices. This can include the seller’s name and contact information, the buyer’s name and contact information, the invoice number, invoice date, payment terms, and a clear description of the goods or services provided. The template should be easy to read and include relevant logos or branding.

Fill out the invoice with the necessary information:

When filling out the invoice, include the information required by the template. This will typically include the names and addresses of the buyer and seller, the date of the transaction, the goods or services provided, the quantity and unit price of each item, any applicable taxes or fees, and the total amount due.

Be sure to include any applicable payment terms, such as the due date and any discounts or late fees that may apply. It’s also a good idea to include optional additional information, such as a purchase order number or delivery date.

Also, consider adding a personal note like ‘Thank you for your business’ or ‘Looking forward to working with you again.’ At the end of the day, you’re dealing with humans and that personal touch can make a big difference if used properly. It’ll build goodwill and when something goes wrong – it almost always will – those personal touches will make your customer more likely to give you a second chance.

Sometimes, invoices may need to be signed. You can take advantage of electronic signature software to do this.

Ensuring accuracy and clarity of the invoice:

To ensure the accuracy and clarity of the invoice, double-check all information before submitting it to the buyer. Make sure that all information is accurate, including the names and addresses of the buyer and seller, the description and quantity of the goods or services provided, and the total amount due.

Check that any applicable taxes or fees have been included, and that the payment terms are clear and easy to understand. It’s also a good idea to proofread the invoice for spelling and grammar errors.

Finally, ensure the invoice is written in a way that is easy to read and understand. You can do this by taking advantage of formatting tools like headings, bold, columns, etc so the information is presented in a logical and organized manner.

Automating the Invoicing Process

Benefits of automating the invoicing process: Automating the invoicing process can provide several benefits, including:

- Time-saving: Automating the invoicing process can save a lot of time compared to manually creating and sending invoices.

- Increased efficiency: Automated invoicing can streamline the entire invoicing process, from creating invoices to sending reminders and tracking payments.

- Improved accuracy: Automated invoicing reduces the risk of errors, such as incorrect calculations or missing information, that can occur when invoices are created manually.

- Better cash flow management: Automated invoicing can help businesses to better manage their cash flow by ensuring that invoices are sent on time and payments are received promptly.

Choosing the right invoicing software: When choosing invoicing software, consider the following factors:

- Cost: Look for invoicing software that fits within your budget.

- Features: Look for software that includes the features you need, such as customizable templates, automated reminders, and reporting tools.

- Ease of use: Look for software that is user-friendly and easy to navigate.

- Integrations: Look for software that can integrate with other tools, such as accounting software or payment gateways.

Setting up the invoicing software: Once you have chosen the invoicing software, set it up by adding your business and customer information. Customize the template to match your branding, and set up payment terms and reminders. Most invoicing software will allow you to apply these settings across the board instead of having to do it for each invoice. Test the software to ensure that it is working properly before sending out any invoices.

Integrating the invoicing software with other tools: To further streamline the invoicing process, consider integrating the invoicing software with other tools such as accounting software, payment gateways, and customer relationship management software. This can help automate the entire invoicing process, from creating invoices to recording payments and managing customer data. Integrations can also provide better insights into your business’s financial health and identify areas for improvement.

Tips for Improving Invoicing Efficiency

Using invoice templates:

Using invoice templates can improve invoicing efficiency by streamlining the process of creating invoices. Templates can be customized to match your branding and include all the necessary information required for each invoice.

This reduces the time it takes to create invoices and ensures that all information is accurate and consistent. Using templates also ensures that invoices have a professional and consistent look and feel, which can improve the customer experience.

Streamlining the approval process:

Streamlining the approval process can improve invoicing efficiency by reducing the time it takes to get invoices approved and paid. This can be achieved by setting up clear guidelines for the approval process and ensuring that all stakeholders are aware of the process.

Consider automating the approval process using software or email workflows to ensure that invoices are reviewed and approved in a timely manner. This can help reduce delays and ensure that payments are received on time.

Offering multiple payment options:

Offering multiple payment options can improve invoicing efficiency by making it easier for customers to pay their invoices. Consider offering a variety of payment options, such as credit card, PayPal, or ACH transfer, to provide customers with options that suit their needs.

This can help to reduce the time it takes to receive payments and improve cash flow. Additionally, consider including a “Pay Now” button or link on invoices, which can make it even easier for customers to pay their invoices quickly and easily.

Obviously, for larger transactions, this may not be an option but for invoices of a few hundred dollars to a few thousand dollars, prioritize convenience.

Ensuring Compliance with Invoicing Regulations

The relevant regulations for invoicing can vary by country and region. Here are some examples of regulations that may apply:

- Tax laws: In many countries, there are regulations that govern how invoices must be structured and what information must be included to comply with tax laws. For example, in the United States, invoices must include the seller’s name and address, the buyer’s name and address, a description of the goods or services sold, the date of the sale, and the total amount due.

- Data protection laws: In some regions, such as the European Union, there are regulations that govern how personal data is collected, processed, and stored. If your invoices contain personal information about your customers, you may need to comply with data protection laws.

- Electronic invoicing regulations: Some countries, such as Brazil and Mexico, have specific regulations around electronic invoicing. These regulations may require that invoices be issued and transmitted in a specific format or using a specific system.

- Business registration regulations: In many countries, businesses must register with the government in order to issue invoices legally. This may involve obtaining a business license or tax identification number.

- Payment regulations: There may be regulations that govern how payments can be made, such as restrictions on certain types of payment methods or limitations on how quickly payments must be made.

It’s important to research the relevant regulations for your region and industry. It’s easy to accidentally exclude something that’s required of you when you’re not sure of the regulations. Working with a qualified accountant or legal professional can help you navigate these regulations and ensure that you are compliant. Of course, compliance can be automated to a certain extent when using the right tools.

Conclusion

Invoices are essential for collecting money owed and maintaining clear records for yourself and your customers. This guide has gone deep into what an invoice is and, more importantly, how to write one the correct way.

Include all the necessary information, be aware of relevant laws, and then send it out with the information they need to make payments. If you have any questions, leave a comment below, and don’t forget to share.