The longer an organization survives, the more it accumulates process debt. This isn’t always due to poor management or processes. It’s inevitable because things are always changing.

The problem with this process debt is that it can drag you down and stunt growth unless you’re proactive about identifying and removing it.

In this guide, you’ll get a deep understanding of what process debt is, why you should tackle it, and several strategies to manage it effectively.

What is process debt?

Process debt can be defined as the accumulation of inefficiencies, complexities, and suboptimal practices in organizational processes over time. It’s similar to technical debt, but instead of focusing on code or system design, process debt pertains to the suboptimal design or execution of workflows, procedures, and operational practices.

Technical debt occurs when shortcuts are taken when developing software and naturally over time. Process debt is the same. Sometimes it’s due to shortcuts, other times it occurs due to lack of experience or expertise, and sometimes it occurs when an organization has to compromise between two subpar options.

Always keep in mind that even if you do everything right, process debt will still accumulate over time. There’s always a better or more efficient way to do something. The older a process is, the more likely it has accumulated process debt.

Causes and sources of process debt:

- Rapid growth or scaling: If you’re building your company or organization quickly, things change just as quickly. It can be difficult to change processes quickly enough to keep up with demand. This may be due to various factors but what usually happens is that a process that’s just good enough for the time being is created and implemented. This leads to process debt.

- Lack of planning and foresight: Similar to just-in-time process creation, when processes are made for the situation at hand and don’t consider the long-term impact, it can lead to rigid and unscaleable processes. These lead to constraints and inefficiencies over time.

- Reactive decision-making: Quick reactions and fixes may be necessary at the moment to tide over a crisis. If processes are implemented this way without further review, it can lead to problems down the line. The more quick fixes, compromises, and workarounds are used, the more process debt it will create in the long term.

- Insufficient documentation and knowledge sharing: If processes aren’t documented in a central location and updated in a timely manner, it leads to process debt. Some people will be using outdated processes, others will use newer ones, and it can even lead to an inconsistent final output.

Examples of common process debt scenarios:

- Inefficient communication channels: For example, relying heavily on email for collaboration or using outdated communication tools can lead to delays, miscommunication, and the accumulation of process inefficiencies.

- Redundant and manual workarounds: For instance, using multiple spreadsheets or manual data entry instead of integrating systems or automating document management tasks can result in errors, delays, and increased effort.

- Outdated technology and tools: Obsolete or outdated technology and tools can contribute to process debt. Using legacy systems or software that lacks necessary functionalities or integrations can hinder productivity and efficiency, accumulating process debt over time.

- Bottlenecks and delays in decision-making: Processes that involve complex approval structures, excessive decision layers, or lack of clear decision-making guidelines can lead to bottlenecks and delays. Slow decision-making can impede progress, hinder agility, and accumulate process debt.

The Importance of Addressing Process Debt

Impact on productivity and efficiency:

At the end of the day, the goal is to be able to do more with less – efficiency. Accumulated inefficiencies, redundancies, and bottlenecks in processes can obstruct work, cause delays, encourage errors, and waste time. All of these things lead to more money being spent on problems and poorer satisfaction within and outside of the organization.

When you’re proactive about addressing process debt, you can squeeze out every ounce of efficiency without undue pressure on your team.

Effect on employee morale and job satisfaction:

Cumbersome processes, manual workarounds, and inefficient systems can frustrate employees and lead to feelings of being overburdened or undervalued. On the other hand, addressing process debt and implementing streamlined processes can empower employees, improve their work experience, and boost morale, resulting in higher job satisfaction and increased engagement.

Risks to customer satisfaction and retention:

Unaddressed process debt can pose risks to customer satisfaction and retention. Inefficient processes can lead to delays in response times, errors in order processing, or breakdowns in communication, all of which can negatively impact the customer experience. Addressing process debt enables organizations to deliver more seamless and efficient interactions, improving customer satisfaction, and increasing the likelihood of customer retention.

Implications for innovation and growth:

Process debt can hinder innovation and stifle organizational growth. Unwieldy processes, complex decision-making structures, and outdated technologies can limit agility and hinder the ability to adapt to changing market dynamics. By addressing process debt and implementing optimized processes, organizations can create a culture of innovation, streamline workflows, and create a foundation for growth and scalability.

Overall, addressing process debt is essential for organizations to achieve their full potential. It leads to improved productivity and efficiency, enhances employee morale and job satisfaction, mitigates risks to customer satisfaction and retention, and creates an environment conducive to innovation and growth. By recognizing the importance of addressing process debt and making it a priority, organizations can position themselves for long-term success in today’s dynamic business landscape.

Identifying and Assessing Process Debt

Conducting a process audit:

- Documenting existing processes: The first step in identifying process debt is to conduct a comprehensive process audit. This involves documenting existing processes and workflows across different departments or functions. It’s essential to capture the end-to-end flow of activities, decision points, and handoffs.

- Analyzing bottlenecks and inefficiencies: During the process audit, analyze bottlenecks, inefficiencies, and areas where delays or errors commonly occur. Review process documentation, conduct interviews with key stakeholders, and observe the execution of processes. Look for repetitive or redundant steps, excessive approval layers, manual workarounds, and other factors that contribute to process debt.

- Identifying areas prone to process debt: Based on the analysis, identify areas or processes that are particularly prone to process debt. These are the areas where inefficiencies, complexities, or suboptimal practices are most evident. It may be helpful to categorize the identified process debt based on severity or impact to prioritize improvement efforts.

Gathering feedback from stakeholders:

To gain a comprehensive understanding of process debt, gather feedback from stakeholders who are directly involved in the processes. This includes employees, managers, and other individuals who have firsthand experience with the processes under review. Conducting interviews, surveys, or focus groups can provide valuable insights into their perspectives on process challenges, pain points, and suggestions for improvement.

Establishing performance metrics and benchmarks:

To assess the extent of process debt and measure improvements, establish relevant performance metrics and benchmarks. These metrics should align with the organization’s objectives and key performance indicators (KPIs). For example, metrics such as cycle time, error rate, customer satisfaction, or process costs can be used to track process performance and identify areas where process debt is impacting organizational outcomes.

By conducting a thorough process audit, gathering stakeholder feedback, and establishing performance metrics, organizations can effectively identify and assess process debt. This comprehensive assessment provides a foundation for prioritizing improvement initiatives and developing action plans to address the identified process debt. Regular monitoring and evaluation of process performance against benchmarks will help track progress and ensure you’re moving towards more optimized and efficient processes.

Strategies for Managing Process Debt

Prioritizing process improvements:

- Identifying critical pain points: Begin by identifying the most critical pain points and areas of process debt within the organization. These are the processes that have the highest impact on productivity, customer satisfaction, or operational efficiency. Prioritizing improvements in these areas will yield the greatest benefits.

- Assessing the potential impact of improvements: Evaluate the potential impact of process improvements in terms of cost savings, time reduction, error reduction, or enhanced customer experience. This assessment helps prioritize improvement initiatives based on the expected return on investment and aligns them with organizational goals and objectives.

- Creating a roadmap for implementation: Develop a roadmap that outlines the sequence of process improvements, timelines, and resource allocation. Breaking down improvements into manageable phases allows for focused efforts and ensures a systematic approach to addressing process debt.

Streamlining processes:

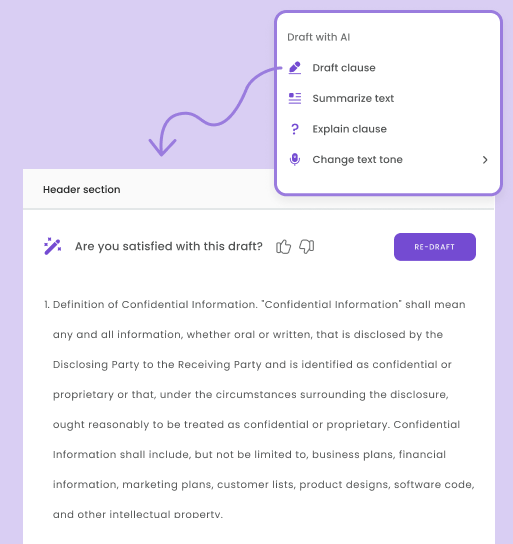

- Automating manual tasks: Identify opportunities to automate manual and repetitive tasks using technology solutions such as workflow automation, robotic process automation (RPA), or artificial intelligence (AI). Automation reduces the chances of errors, improves efficiency, and frees up employees’ time for more value-added activities.

- Eliminating redundant steps: Analyze processes to identify and eliminate redundant or unnecessary steps. Streamline workflows by removing bottlenecks, simplifying decision-making processes, and optimizing the sequence of activities. This ensures smoother process flows and reduces the accumulation of process debt.

- Improving communication and collaboration: Enhance communication and collaboration channels within the organization to facilitate seamless information exchange, decision-making, and knowledge sharing. Implementing collaboration tools, project management software, or communication platforms can improve transparency, reduce miscommunication, and eliminate process inefficiencies.

Implementing agile and iterative approaches:

- Conducting regular retrospectives: Conduct periodic retrospectives to reflect on process improvements, identify areas for further optimization, and learn from past experiences. Retrospectives enable teams to continuously assess and refine processes, ensuring ongoing process improvement and preventing the re-emergence of process debt.

- Embracing continuous improvement: Build culture of continuous improvement by encouraging employees to identify and suggest process enhancements. Implement feedback loops, suggestion systems, or process improvement initiatives to empower employees and involve them in the ongoing effort to manage and prevent process debt.

Investing in technology and tools:

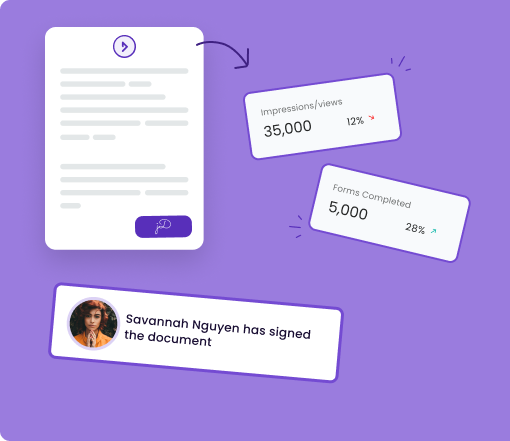

- Assessing current systems and identifying gaps: Assess the organization’s current technology landscape and identify any gaps or limitations that contribute to process debt. Determine the technology requirements for process optimization and invest in upgrading or implementing new systems and tools accordingly. For example, if you’re still manually signing documents, you may need to invest in electronic signature software. If you’re using pen and paper to manage projects, you may need to invest in project management software.

- Exploring process management software and solutions: Explore process management software and solutions that can help streamline, automate, and monitor processes effectively. These tools provide visibility into process performance, facilitate collaboration, and enable data-driven decision-making.

- Training employees on new tools and technologies: It’s essential that employees have the necessary skills and knowledge to effectively use relevant tools to enhance adoption, efficiency, and the overall success of process improvements. Without continuing training and or education, the initiatives you attempt to implement will fall short of your expected goals.

By implementing these strategies for managing process debt, you can systematically address inefficiencies, streamline workflows, and prevent the accumulation of new process debt. Regular monitoring, evaluation, and continuous improvement efforts will help sustain optimized processes and create a culture of ongoing process excellence.

Overcoming Challenges in Addressing Process Debt

Resistance to change and inertia:

Resistance to change is a common challenge when addressing process debt. Employees may be comfortable with existing processes or hesitant to embrace new ways of working. To overcome this challenge, focus on effective change management. Engage employees early in the process, communicate the reasons for change, and provide training and support to help them adapt to new processes. Address concerns and provide opportunities for feedback to create buy-in and ownership of the improvements.

Limited resources and budget constraints:

Addressing process debt requires resources, including time, personnel, and technology investments. Limited resources and budget constraints can pose challenges in implementing process improvements. Overcome this challenge by prioritizing improvements based on their potential impact, return on investment, and alignment with strategic objectives. They can also explore cost-effective solutions, leverage internal expertise, or seek external partnerships to optimize resource utilization.

Balancing short-term fixes with long-term improvements:

In the urgency to address process debt, you may need to resort to short-term fixes or workarounds. While these temporary solutions can provide immediate relief, they can perpetuate the cycle of process debt if long-term improvements are not pursued. To overcome this challenge, strike a balance between short-term fixes and long-term improvements. Prioritize long-term solutions that address root causes and provide sustainable benefits, while managing short-term challenges to maintain operational continuity.

By proactively addressing these challenges, organizations can successfully overcome barriers to addressing process debt. With effective change management, resource optimization, a focus on long-term improvements, and a commitment to sustaining process excellence, organizations can achieve optimized workflows, enhanced efficiency, and a culture of continuous improvement.

Conclusion

Process debt starts slowly but can quickly snowball into something that’s unmanageable. To prevent this, it’s important to understand what process debt is, how to identify it, and the steps needed to tackle it head-on.

Fortunately, this guide has covered those topics and many more. You should have a solid understanding of what process debt is and how to approach it.

Now, focus on identifying areas where process debt has taken hold and then use the strategies outlined in this guide to begin addressing it. Let me know what you think in the comments and don’t forget to share.