There are many agreements that need additional protection. If there is an inherent element of danger or even if you’re in a litigious society, you want to make sure your interests are protected. That’s where the indemnification clause comes in.

In this guide, you’ll get a deep understanding of what an indemnification clause is, what it can do, and situations where it should be used.

Understanding Indemnification Clauses

Indemnification is a legal concept. One party (the “indemnitor”) agrees to compensate or protect another party (the “indemnitee”) against specific losses, damages, liabilities, or costs that might arise due to certain actions, events, or circumstances. Indemnification clauses are contractual provisions that outline the terms and conditions under which one party agrees to indemnify the other.

Below are some of the reasons indemnification clauses are used in contracts:

- Risk Allocation: Indemnification clauses help allocate the risks associated with potential losses or liabilities. The group with more control over a specific aspect of the contract might agree to indemnify the other party for related risks. For example, banks are indemnified against certain risks when performing transactions for account holders.

- Protection: Indemnification provides a level of protection for one party against unforeseen or uncontrollable events. It can safeguard the indemnitee from financial losses arising from circumstances beyond their control.

- Encouraging Responsible Behavior: By agreeing to indemnify, parties might be incentivized to act responsibly. This may include taking necessary precautions to avoid actions that could trigger indemnification obligations.

Scope of Indemnification: Parties Involved and Potential Liabilities:

- Parties Involved: Indemnification clauses specify who is subject to indemnification obligations. This often includes the one providing indemnification (indemnitor) and the one receiving indemnification (indemnitee).

- Potential Liabilities: The scope of liabilities covered by indemnification can vary widely based on the contract’s terms. Liabilities might include third-party claims, legal fees, damages, losses, or costs arising from specified actions or events.

Indemnification clauses can vary in their wording and scope. Depending on the nature of the agreement and the parties’ negotiation it can be narrow or broad. Careful drafting is needed to ensure that the obligations and responsibilities are clearly defined, and potential risks are adequately addressed.

Elements of an Indemnification Clause

A. Identification of Indemnitor and Indemnitee:

- Indemnitor: The person or entity that’s providing indemnification. They commit to compensating or protecting the other party from specific risks.

- Indemnitee: The person or entity that’s receiving indemnification. They are the ones who seek protection from potential losses or liabilities.

B. Description of Covered Claims and Liabilities: Clearly define the scope of claims and liabilities that will trigger indemnification. It’s important to spell it out in full and in language that’s easy to understand. It’ll prevent many issues if the indemnification clause needs to be invoked. This can include:

- Third-party claims arising from certain actions, negligence, breaches, or events.

- Specific types of losses, damages, expenses, or costs that may be indemnified.

C. Allocation of Responsibility for Costs and Damages: Specify how the costs, damages, and expenses will be covered if an indemnity clause is invoked:

- Indicate whether the indemnitor will cover legal fees, settlement amounts, or other related costs. Will they play the full amount or a partial amount? Is there a limit to the liability that the indemnitor will need to shoulder?

- Outline the process for calculating the indemnification amount.

D. Scope and Limitations of Indemnification: Set boundaries for the indemnification obligation:

- State whether the indemnification is limited to certain scenarios or events.

- Clarify if there are any exceptions or exclusions to the indemnification obligation.

E. Procedures for Notifying and Addressing Claims: Provide guidelines for dealing with indemnification claims:

- Describe the process for notifying the indemnitor about potential claims.

- Outline the steps both parties must follow to address claims, including timelines for responding and resolving disputes.

Crafting a clear and comprehensive indemnification clause is crucial to ensure that both parties understand their obligations and the potential scenarios that may trigger indemnification. Properly addressing these elements can help prevent misunderstandings and disputes down the line.

Types of Indemnification

Indemnification comes in many forms. It can be narrow and specific or broad and all-compassing. The type of indemnity provided will vary based on the situation and the needs of the parties.

Broad Indemnity:

- All-Encompassing Coverage: Broad indemnification clauses provide extensive protection to the indemnitee. The indemnitor agrees to cover a wide range of claims, liabilities, losses, and expenses, even if they might not be directly related to the indemnitor’s actions.

- Example: A supplier might offer broad indemnification to a buyer, covering any and all claims arising from the use of the supplied product.

Limited Indemnity:

- Specific and Predefined Situations: Limited indemnification clauses narrow the scope of protection to particular scenarios, actions, or events that the parties agree upon. This is the most common type of indemnity used in contracts.

- Example: An event organizer might offer limited indemnification to a venue owner, covering only damages caused by the event attendees within the venue during the event hours.

Reciprocal Indemnity:

- Bilateral Protection for Both Parties: In reciprocal indemnification, both parties mutually agree to indemnify each other. This approach ensures that both sides are protected from potential risks. Even though both parties are protecting each other, one party will need to take responsibility for specific situations.

- Example: In a joint venture, both partners might include reciprocal indemnification clauses, agreeing to indemnify each other against any claims arising from their respective activities.

No-Fault Indemnity:

- No-fault indemnification clauses remove the requirement to prove fault or negligence. The indemnitor agrees to indemnify the indemnitee regardless of whether the indemnitee is at fault for the claims. This is not as common as limited indemnity.

- Example: A manufacturer might offer a no-fault indemnification clause to a distributor, ensuring that the distributor is protected even if the claims are a result of the distributor’s actions.

The type of indemnification chosen depends on the parties’ negotiation, the nature of the agreement, and the level of protection needed. Understanding these types can help parties tailor indemnification clauses to best suit their needs and risk tolerance.

Indemnification Clause Pitfalls to Avoid

A. Excessive or Unbalanced Liability:

- Excessive Indemnification: Drafting an indemnification clause with overly broad language can expose the indemnitor to excessive and unjustifiable liabilities. It’s important to balance the scope of indemnification with the actual risks involved.

- Unbalanced Allocation: Imposing disproportionately high indemnification obligations on one party while neglecting the other’s potential liabilities can lead to an unfair contract and possible disputes.

B. Inadequate Definitions and Scope:

- Lack of Clear Definitions: Failing to define key terms and concepts can create confusion and open the door for differing interpretations, potentially resulting in disputes.

- Limited Scope: Drafting a clause with a narrow scope may lead to unforeseen gaps in coverage. It’s crucial to anticipate a wide range of scenarios that might require indemnification.

C. Ignoring Jurisdictional and Legal Considerations:

- Jurisdictional Differences: Neglecting to consider the legal requirements and standards specific to the jurisdiction where the contract will be enforced can render the indemnification clause ineffective or unenforceable.

- Applicable Laws and Regulations: Ignoring laws and regulations that govern certain indemnification clauses, such as those subject to the “Statute of Frauds,” can lead to legal challenges.

Avoiding these pitfalls requires a thorough understanding of the contractual relationship, potential risks, and the legal landscape. Careful drafting and consideration of each party’s interests can help create an indemnification clause that is fair, clear, and legally sound.

Conclusion

Indemnification clauses are fairly common in contracts whether they’re express contracts or oral contracts. The key is to understand how far the indemnification will reach. Do you want to indemnify the other party for everything or just specific actions that you may take on their behalf?

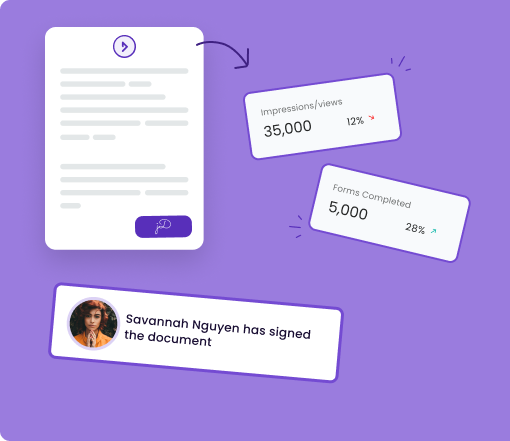

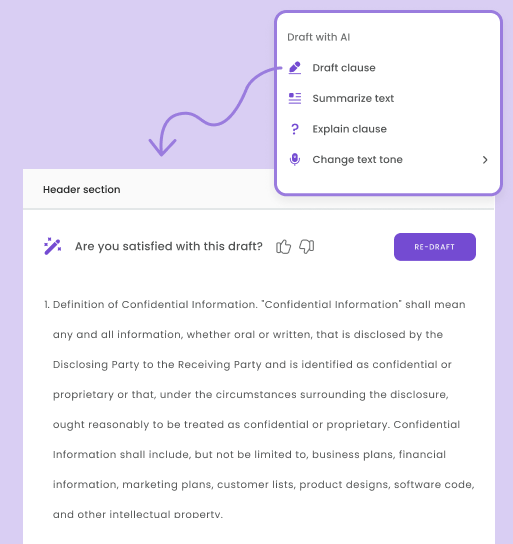

Use this article as a guide to draft clauses that meet your needs and those of your partners, customers, and vendors. Once you have a solid indemnification clause, consider automating documents that contain it using DoxFlowy.