In a perfect world, all loans would play out as expected. There are regular payments until the loan and interest are paid off.

This isn’t a perfect world and things happen.

That’s what an acceleration clause is for. When certain conditions are met, it kicks in and requires immediate action from the debtor.

In this guide, you’ll understand what an acceleration clause is, how it works, the different types of acceleration clauses, and much more.

Definition of an Acceleration Clause

An acceleration clause is a portion of a contract that is often seen in loan agreements, mortgages, and leases. It allows the creditor or landlord to request the entire loan balance or lease balance be paid immediately when specific conditions are met.

The conditions that trigger an acceleration clause tend to be things like defaults or certain extraordinary events. These include missing payments, violating the conditions of the agreement, or other significant breaches. This is not something normally used in a standardized contract.

As the name suggests, the clause “accelerates” the time in which the outstanding amount becomes due. The debtor or lessee no longer has the option to make periodic payments and instead must pay the entire balance at once.

An acceleration clause is a type of contingency clause that’s used to protect lenders and lessors from default. It lays out specific remedies when the other party fails to meet their obligations.

For example, if a borrower misses a payment on their mortgage, the lender might invoke the acceleration clause, demanding the full amount owed on the loan immediately.

The clause can be found in various types of contracts like commercial leases. If a major breach of contract terms occurs, it can be triggered and the lessee will be required to pay all rent payments immediately.

In a personal loan scenario, the acceleration clause may be triggered if the debtor misses their regular payments. It provides the lender legal recourse to collect the full loan amount without needing to continue waiting for the agreed term to expire.

An acceleration clause is a powerful tool to manage financial risk. It provides a tool for them to use when trying to recover their investment after a contract breach has occurred.

A borrower or lessee should be aware of what the acceleration clause entails and how it’ll be triggered. It’ll be a severe financial burden to be required to pay a large sum of money immediately.

This type of clause can serve parties on both sides of the agreement. For the lender, it serves as a form of protection. For the borrower, it serves as motivation.

How an Acceleration Clause Works

Mechanism of Acceleration Clauses

An acceleration clause allows the lender or lessor to demand the immediate repayment of the entire outstanding balance of a loan or lease when specific conditions are met.

Once triggered, it changes the repayment structure from regular, scheduled payments to a lump sum due immediately.

This provision is designed to mitigate risk and protect the financial interests of the lender or lessor by ensuring they can recover their funds promptly in the event of a significant default or breach.

Conditions that Trigger the Clause

Any condition, as long as it’s agreed upon and place within the contract, can trigger the acceleration clause. With that being said, there are common situations that are prevalent in contracts.

First, missing payments is one of the most common triggers. This could be for a personal loan or mortgage. Another common reason is for breaching the terms of the agreement. Usually, it’s a serious breach of the contract but, as long as you both agreed, it can also occur for a minor contract breach.

Acceleration clauses may be activated by indirect financial issues such as the lessee declaring bankruptcy or suddenly losing a lot of money which brings their ability to pay into question.

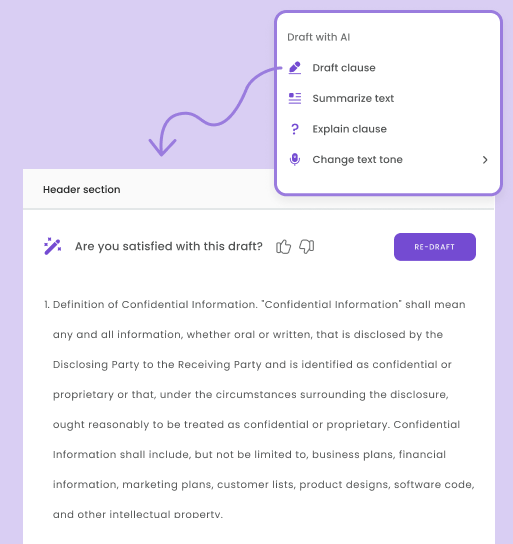

Examples of Acceleration Clause Language in Contracts

For example, a mortgage contract might include language stating, “If the borrower fails to make any monthly payment within 30 days of its due date, the lender may declare the entire remaining balance of the loan immediately due and payable.”

Similarly, a commercial lease might contain a clause like, “In the event that the lessee fails to comply with any material term of this lease, the lessor reserves the right to demand the total unpaid rent for the remainder of the lease term to be paid immediately.”

These clauses ensure that the lender or lessor has a clear and enforceable right to collect the full amount owed without the delays and uncertainties of regular collection efforts.

For borrowers and lessees, it emphasizes the importance of adhering to the contract terms, as triggering an acceleration clause can lead to significant financial consequences.

Types of Acceleration Clauses

Acceleration clauses can generally be categorized into two types: optional and automatic. Each type has distinct characteristics and implications for the lender or lessor and the borrower or lessee.

Optional vs. Automatic Acceleration Clauses

Optional acceleration clauses give the lender or lessor the discretion to decide whether to accelerate the repayment of the entire outstanding balance upon the occurrence of a triggering event.

In other words, the lender or lessor can choose to enforce the acceleration clause but is not obligated to do so.

This type of clause allows for flexibility and can enable the lender or lessor to negotiate alternative solutions with the borrower or lessee, such as restructuring the payment plan or granting a grace period.

Automatic acceleration clauses, on the other hand, are triggered immediately and without discretion when specific conditions are met.

Once the triggering event occurs, the entire outstanding balance becomes due automatically, and the lender or lessor does not have the option to waive or modify this requirement.

This type of clause provides a clear and enforceable remedy for the lender or lessor, ensuring swift action can be taken to recover the owed amount.

Differences Between These Types

The primary difference between optional and automatic acceleration clauses lies in the level of discretion afforded to the lender or lessor.

Optional clauses offer flexibility and the potential for negotiated resolutions, whereas automatic clauses enforce strict and immediate repayment terms.

This difference can impact the borrower or lessee, as optional clauses may provide more room for addressing payment difficulties, while automatic clauses can lead to immediate financial strain if the balance becomes due all at once.

Specific Examples and Their Implications

An example of an optional acceleration clause might be found in a loan agreement stating, “In the event of default, the lender may, at their discretion, declare the entire remaining balance of the loan immediately due and payable.”

This allows the lender to assess the situation and potentially work out a new arrangement with the borrower.

Conversely, an automatic acceleration clause in a mortgage might read, “If the borrower fails to make any payment by its due date, the entire remaining balance of the loan shall automatically become due and payable.”

This leaves no room for negotiation and ensures the lender can take swift action to recover the funds.

Optional acceleration clauses can provide a safety net for borrowers and lessees, allowing them to seek remedies and avoid immediate financial hardship.

Automatic acceleration clauses, while providing security and quick recourse for lenders and lessors, can create substantial financial pressure for borrowers and lessees, potentially leading to foreclosure or eviction if they are unable to meet the sudden demand for full repayment.

Uses and Benefits of Acceleration Clauses

Acceleration clauses serve several important purposes in financial and lease agreements, offering protections and incentives that benefit lenders, landlords, borrowers, and tenants alike.

Understanding their uses and benefits highlights why these clauses are a common feature in various types of contracts.

Protection for Lenders and Landlords

One of the primary uses of acceleration clauses is to protect lenders and landlords.

By including an acceleration clause, lenders and landlords ensure they have a mechanism to recover the full amount owed in the event of a default or significant breach of contract.

This protection is particularly crucial in long-term agreements like mortgages and leases, where the financial exposure can be substantial.

If a borrower or tenant fails to meet their obligations, the acceleration clause allows the lender or landlord to demand immediate repayment, reducing the risk of prolonged defaults and potential financial losses.

Incentives for Borrowers and Tenants to Comply with Contract Terms

Acceleration clauses also serve as a powerful incentive for borrowers and tenants to comply with the terms of their agreements.

Knowing that a missed payment or breach of contract could trigger the requirement to pay the entire outstanding balance immediately, borrowers and tenants are more likely to adhere to their payment schedules and other contractual obligations.

This compliance not only benefits the lender or landlord by ensuring steady and reliable payments but also helps borrowers and tenants avoid the severe financial consequences of triggering an acceleration clause.

Role in Risk Management for Financial Institutions

For financial institutions, acceleration clauses play a critical role in risk management.

These clauses provide a clear and enforceable remedy for dealing with defaults and breaches, enabling institutions to manage their portfolios more effectively.

By reducing the uncertainty and potential losses associated with non-performing loans or leases, acceleration clauses help financial institutions maintain their financial stability and protect their assets.

Moreover, the presence of acceleration clauses can improve the creditworthiness of a loan or lease, as it assures that the lender or landlord has a recourse to quickly recover funds if needed.

In essence, acceleration clauses are vital tools in financial and lease agreements. They offer protection and security for lenders and landlords, encourage compliance from borrowers and tenants, and enhance risk management strategies for financial institutions.

These benefits make acceleration clauses a standard feature in many contracts, ensuring that all parties know their responsibilities and the potential consequences of failing to meet them.

Potential Drawbacks and Risks

While acceleration clauses offer significant benefits in terms of protection and risk management for lenders and landlords, they also come with potential drawbacks and risks.

This is particularly so for borrowers and tenants. Understanding these risks is crucial for all parties involved in such agreements.

Risks for Borrowers and Tenants

For borrowers and tenants, one of the primary risks associated with acceleration clauses is the sudden financial burden that can result from triggering the clause.

If a borrower or tenant defaults on a payment or breaches the terms of the contract, they could be required to pay the entire outstanding balance immediately.

This can be financially devastating, especially if the borrower or tenant does not have the resources to cover the lump sum payment.

Additionally, the existence of an acceleration clause can create stress and anxiety, as even minor financial setbacks could lead to severe consequences.

Legal and Financial Consequences of Triggering an Acceleration Clause

Triggering an acceleration clause can have significant legal and financial consequences. Legally, the borrower or tenant may face foreclosure or eviction if they cannot pay the accelerated amount.

This can result in the loss of property, damage to credit scores, and long-term financial repercussions.

Financially, the borrower or tenant may need to liquidate assets, take out additional loans at potentially unfavorable terms, or even declare bankruptcy to meet the payment demand.

Furthermore, the legal process of enforcing an acceleration clause can be complex and costly, potentially involving court proceedings and legal fees.

Examples of Disputes or Complications Arising from Acceleration Clauses

Disputes and complications arising from acceleration clauses are not uncommon. For example, a borrower might argue that the lender improperly invoked the acceleration clause, either by not providing adequate notice or by misinterpreting the terms of the contract.

Such disputes can lead to protracted legal battles, further straining the financial resources of both parties.

Additionally, complications can arise if the borrower or tenant is unable to secure funds to pay the accelerated amount, leading to lengthy foreclosure or eviction processes that benefit neither party.

In one notable case, a homeowner facing foreclosure due to a triggered acceleration clause disputed the lender’s right to accelerate the loan, arguing that the notice of default was not properly delivered.

The case went to court, resulting in a prolonged and costly legal process for both sides.

In another example, a commercial tenant faced immediate eviction after breaching a lease term that triggered the acceleration clause.

The tenant argued that the breach was minor and did not warrant such severe action, leading to a legal dispute that disrupted the tenant’s business operations.

These examples illustrate that while acceleration clauses provide important protections for lenders and landlords, they can also lead to significant challenges and conflicts.

Borrowers and tenants must carefully consider the terms of any agreement containing an acceleration clause and understand the potential risks involved. For lenders and landlords, it’s important to ensure that acceleration clauses are clearly drafted and properly enforced to avoid disputes and complications.

Conclusion

An acceleration clause can be a powerful tool to protect your interests when lending to borrowers or leasing to tenants.

It makes sure the landlords or lenders can recover their funds or prevent unpaid vacancies. With that being said, it’s favorable to the landlord and can be unfavorable to the tenant.

Whether you’re a tenant or landlord, consider the pros and cons of using an acceleration clause – especially automatic ones. It can cause major disputes and costly legal battles if applied incorrectly.

Let me know what you think in the comments and don’t forget to share.